Timely filing means the strict deadline each insurer sets for submitting a claim after the date of service. If you miss this window the insurer will automatically deny the claim. In 2025, meeting these deadlines remains critical. Submitting claims on time dramatically improves your practice’s finances. You will get paid faster and more fully and avoid costly denials. For example, on-time claims lead to faster reimbursements and steadier cash flow, while late claims are often denied or paid at reduced rates. Timely filing also reduces rework and appeals, saving administrative effort and ensuring compliance with insurance contracts, thereby avoiding audits or payer disputes.

Timely filing limits are the maximum time allowed to submit a claim to an insurer after a patient’s service. Each insurer enforces a firm deadline including Medicare and Medicaid

Each insurer including Medicare and Medicaid enforces a firm deadline. File after that window and the claim is denied with no payment. Medicare generally requires claims to be submitted within 12 months of service, while many state Medicaid programs allow claims to be submitted 90 to 365 days after the service was provided. Major commercial payers typically give 90–180 days. In short, knowing and respecting each payer’s deadline is essential to avoid outright denials.

Submitting claims promptly often means quicker insurer payments. Early payments improve cash flow, so practices can pay staff and vendors on time

Insurers are much more likely to pay a claim in full when it’s filed on time. After the deadline passes, many payers will deny the claim or only reimburse partially

Late claims trigger appeals and re-submissions creating a backlog of paperwork. Filing on time avoids these hassles and lets staff focus on patient care

Most insurance contracts require claims within 90–180 days of service. Missing these windows can breach agreements and invite audits or lost payer privileges.

Consistently timely claims mean steady payments. This predictability allows practices to invest in growth and patient care rather than chasing overdue claims.

By prioritizing timely filing in 2025, providers can minimize claim denials in medical billing and maximize collections.

Timely filing deadlines vary by payer. For example, Medicare typically enforces a 12-month (365-day) filing limit and state Medicaid programs range anywhere from 90 days up to a year (depending on the state). Commercial insurers each set their own rules in contracts. Below are typical filing windows for major U.S. payers.

|

Payer |

Timely Filing Limit (from date of service) |

|

Medicare (all parts) |

12 months (365 days) |

|

Medicaid (varies by state) |

Usually 90–180 days; some states allow up to 1 year |

|

Aetna (commercial) |

120 days |

|

Anthem (BCBS OH, KY, IN, WI) |

90 days |

|

UnitedHealthcare |

90 days |

|

Cigna |

90 days (in-network); 180 days (out-of-network) |

These values come from payer guidelines and industry sources. For instance, Medicare’s 12 month limit is standard across providers and many payers’ initial claims deadlines fall in the 90 to 120-day range. Note that every contract is unique. Always verify each payer’s current rule.

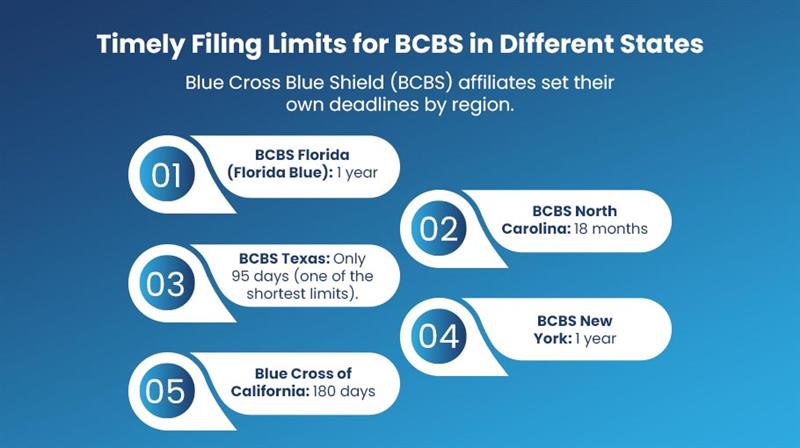

Blue Cross Blue Shield (BCBS) affiliates set their own deadlines by region.

These illustrate the wide range of BCBS policies. In practice, always check the patient’s specific BCBS plan and state rules. Many BCBS carriers publish timely filing information online or in provider manuals for each state.

Missing a timely filing deadline has severe consequences. Late claims are usually denied outright (resulting in lost revenue) and the practice must then spend hours on appeals that often fail. Appeals are time-consuming with no guarantee of success. This domino effect increases administrative burden, stalls cash flow and even raises the risk of audits or payer scrutiny. To avoid these outcomes, providers must address the common causes of missed deadlines.

If clinicians do not finish the medical notes or coding promptly, the claim cannot be prepared on time

Errors in patient demographics, insurance IDs or plan information prevent claims from going out. A typo or outdated info can stall processing.

Not verifying a patient’s coverage or coordinating benefits with other insurers can delay filing. Unresolved eligibility problems may leave a claim unsubmitted until the issue is cleared.

Forgetting to obtain a prior authorization or the correct referral number often stops billing until the documentation is secured.

Claims can’t be billed if the rendering provider isn’t enrolled with the payer. If credentialing is pending, related claims get delayed.

When a clearinghouse or billing software rejects a claim (e.g. format or edit error) and this goes unnoticed, the clock keeps running. By the time you catch it, the deadline may have passed

Each of these issues effectively “wastes” time and can cause claims to miss the filing window. Addressing data accuracy and workflow efficiency is the first step to reducing timely filing denials.

Proactive processes and technology are crucial in preventing late claims. The following are the ways to avoid timely filing denials.

Always confirm active coverage and get correct insurance details when the patient arrives. Use real-time verification tools and capture effective dates of coverage. This ensures the claim can be filed promptly.

Encourage providers to finish notes and coding immediately after the encounter. Delays in closing encounters or getting signatures directly slow down billing. A complete chart on time means the claim can be assembled and filed without holdups.

Automated claim scrubbers catch missing data or coding errors before submission. These tools flag incomplete demographics, wrong CPT/ICD codes and other errors that would cause rejection. Clean claims clear the payer’s edits and keep the filing clock moving.

Don’t wait until the very last day. Establish internal deadlines ahead of each payer’s limit. For example, if a payer allows 120 days, aim to submit within 90 days. This buffer gives your team time to handle any issues.

Use your practice management or RCM software to flag claims nearing the deadline. Set alerts for aging claims.. Automate follow-ups for missing authorizations or eligibility proofs. These proactive flags ensure you catch problems early.

Consider specialized denial-management services or systems. Many outsourced RCM teams use denial-management software that automatically tracks all payer deadlines and alerts staff of issues. Such solutions help catch late claims or coding errors before a denial occurs and streamline appeals when needed.

Providers can keep claims on time and minimize denials in medical billing by combining these best practices.

If a claim has already missed the deadline, act quickly:

In short, timely filed claims have the best chance for resolution. Once the filing window closes, appeal options are very limited.

To stay ahead of deadlines and denials, providers should adopt these habits.

Providers can significantly reduce claim denials and keep their revenue cycle flowing smoothly by adopting these practices.

What is a typical timely filing limit for Medicare?

Medicare requires claims to be filed within 12 months (365 days) of the service date. Claims submitted after this period are usually denied (with very few exceptions).

Is the timely filing limit the same as the appeal deadline?

No. The timely filing limit applies to the original claim submission. Appeal deadlines are separate and begin from the date of denial. For example, Medicare gives 120 days to request redetermination after a denial, while commercial insurers often allow 60–180 days for appeal

What happens if I file a claim one day late?

Most insurers will deny the claim. Even a claim filed just one day past the deadline is typically considered untimely and payment is forfeited unless you can prove an extraordinary exception.

How long do Medicaid plans allow for filing?

Medicaid deadlines vary by state. Generally, states allow 90–180 days from the service date. Some states offer extensions for special circumstances (such as verified retroactive eligibility). Always check the specific state’s Medicaid guidelines.

Can outsourcing billing or using an RCM service reduce timely filing denials?

Yes. Professional billing services and outsourced RCM firms use automated tracking of payer deadlines and proactive workflows. Studies show that such solutions can substantially reduce the rate of timely-filing denials by monitoring all payer rules in real-time.

How can I prevent denials in medical billing?

Verify insurance, file promptly and ensure claims are clean before submission. Tools like claim scrubbers and denial management software help catch issues early. By staying organized and using these strategies you can greatly reduce claim denials and improve reimbursement.

Timely filing limits remain a critical compliance point in 2025’s medical billing environment. Every insurer, from federal programs to private payers, enforces strict deadlines and missing them almost always means no payment. However, a disciplined process (eligibility checks, clean claims, internal deadlines) combined with modern tools (claim scrubbers, RCM software, denial management) can virtually eliminate these denials. Healthcare practices that respect filing windows will see faster reimbursements, fewer denials in medical billing and stronger cash flow. In the end, timely claims handling is not just an administrative detail, it directly impacts the practice’s financial health and ability to care for patients.

Optimize billing, claims and collections with expert RCM support let our professionals handle the process so you can focus on patient care.